1. How Bryan came up with his own accounting system

I’m sure this doesn’t pertain to all translators out there, but at least of the ones I’ve known, most of them are great with languages but not so great at running a business or dealing with numbers. A lot of them would automatically react with a frown if I told them they need to have a working accounting system. Actually, I used to be the same way. (And to be completely honest, I still am.) When I was first starting out as a freelance translator, the only thing I was concerned about was translating documents, and the thought of making invoices or managing them in a systematic way didn’t even cross my mind.

But at some point, you have to face reality. And as a freelance translator, you are running a single-person business, which means you need to send your clients what they need in order to complete the transactions. And once you start having more clients, it will be increasingly difficult to rely on your memory alone to remember who has sent you how much and when. In my case, I needed to keep a record of all of my paperwork for 7 consecutive years for tax reasons (because I live in Canada) so I really needed to come up with a systematic accounting system. (To clarify, the system is not just for other people. I didn’t know this at the time, but it’s actually more important for yourself to have one. But I’ll get into that later.)

Though I knew it was necessary, I kept putting it off until one day, I finally decided to suck it up and deal with the problem head-on. I mean, how hard could it be? I was willing to spend some cash if necessary, and so I began my research on-line and began constructing my own accounting system. There are two things I discovered in this process. First, there was no particular system that was recommended for people within the translation community (For instance, click HERE. and secondly, all the software on the market for sale were expensive, and I needed to teach myself how to use them after buying it which made them burdensome. I didn’t like this at all. So I opted instead to download a free invoice form I found online and tried to craft my own. Since I really dislike this type of work, my goal was to come up with the easiest and the most convenient system to use, one that would take the least of time and effort to sustain.

After I finished creating the first version of the system, I kept tweaking it bit by bit so I’m not sure exactly how much time and effort in total I have put into turning it into what it is today, but in general, my system still works fantastically even now. I don’t claim that mine is the best system out there. Of course, it isn’t. But that wasn’t my intent, and I don’t kid myself into thinking I could make the best version even if I tried. Regardless, I still ended up with an excellent system, and this is the reason why I thought about turning it into a course and offering it to people for sale. And I say this for the following reasons.

- The only cost involved in building and maintaining this system is the cost of this course. There are no other costs. (affordable)

- This system is easy to understand and use (easy to use)

- It satisfies the needs of everyone: clients, accountants, government and myself. (effective)

- It’s easy to change this system to meet a particular client’s request or if I just want to (flexible)

- It’s easy to expand upon if I gain a lot more clients and when the year changes. (scalable)

If you think a translator’s accounting system requires things other than the ones stated above, please ignore this course and by all means create one for yourself or purchase a different accounting system that is available online. Office software for freelance translators usually let you create invoices. For example, click HERE. But even for a very low level (less than 250 clients), it will still cost around 125 dollars a year for a subscription which you’ll need to renew each year. After you buy it, you also need to learn how to use the system. These systems might look fancy, but one, they are overpriced, and it will take a lot of work to learn the system, and you’ll most likely find it frustrating that you can’t control it at your will.

On the other hand, my system may not be very fancy, but since it uses Excel, it is cost free, easy to use, and all you have to do is download the file I’ve already created and input your own data and voila, it will be ready to use. Of course, you can also change it to suit your taste so you have all the control. Of course, it will help if you already have a bit of background knowledge about Excel, but even without it, you will quickly understand it after reading my explanation. I know this because I’m not great at Excel either, yet I still managed to create this system, which means it cannot be that difficult.

2. Structure of the accounting system

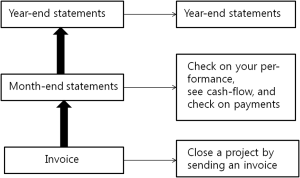

My accounting system is really quite simple. It can be explained by the drawing below. (In the boxes: End of the year filing, end of the month filing, make invoice, file taxes, determine long-term business prospects and strategies, check performance, predict cash flow, confirm deposit, send to client and end project)

As you can see in the picture, the thing that is the most basic yet the most important is creating your invoices. When a client sends you a project, they’ll send you a PO(purchase order) which is like a contract. Once the translator has completed the project, he or she will need to create an invoice that matches the contents in the PO (you’ll need to put the PO number in the invoice). This is the last step in a translator’s normal job, and once the client receives the invoice, they now have the obligation to pay you. Thus, creating and sending an accurate invoice that includes every item requested by the client is a translator’s important daily task. (I’ve heard that some agencies in Korea pay translators without invoices, but I’m not sure if this means they want to treat the translators as their own employees. Invoices are a way in which service providers request payment to the service receiver (aka client), and the client is obligated to pay exactly the amount and via the exact method stated in the invoice. They also serve as the basis for the client to be able to pay the stated amount to the translator, so how any business could operate without receiving them is beyond me. Furthermore, if that were the case, then any translator would only have his/her memory to know whether he/she had received all of their payments from their clients since they wouldn’t have their invoices to verify that.)

The next thing is end of the month filing. This isn’t anything too complicated. It just means that at the end of the month, you are going to gather all the invoices you have written that month and organize them. You don’t need to collect every little detail here, but just select all the ones that are important for you (not the clients) and turn them into a single (or a few) page(s). You might be thinking, ‘invoices are necessary because clients request them and you need to get paid, but what’s the point of spending all this time doing this at the end of the month?’ I used to think that too. I figured it wasn’t really necessary since I wasn’t running a big business. But let me be clear that this work is absolutely necessary for you (and again, not for your clients) because in one page, it lets you see all the work you’ve done that month, and how much money you’re owed by which clients. You can also assess your cash flow to an extent just with one glance. Finally, you can use this file to check every quarter or every six months if you’ve received all the payments that you’re owed.

The last stage is end of the year filing. You can evaluate how well your business has performed by calculating your total revenue and cost for the year (End of the year usually means end of the fiscal year, but here, I’m making it the same as the calendar year.) And you can use this to file your taxes. However, your end of the year filing doesn’t just help you with your taxes. It also serves as very helpful data giving you an overall view of how your business is doing so you can use this information to create a long-term business plan. This data is crucial because it reveals a lot about your income structure (types of sales, which clients are the most important) and monthly increase in revenue so you can come up with strategies based on the overall assessment of how your business is doing. For instance, if a huge chunk (too much) of your sales is coming from one client (too much being above 30% according to my standard), you can decide to try and reduce that so your business isn’t too dependent on one client and create a more stable stream of revenue in the long run. At this point, you can also check what percentage of the work you’re doing is general translation vs. work in specialized fields that you’ve chosen and come up with a long-term action plan accordingly. (For instance, you can start looking more actively for clients in your specialized fields or make a plan to get certified in those fields, etc.) This would be equivalent to the type of work that higher level management does at bigger companies. But for freelancers, you are the upper management and the CEO, so you need to figure out the current status of your business and decide what direction you want to take it. Since I usually do the end of the year filing in January, I think a lot about this stuff and make my decisions then.

The next thing is filing of your taxes, but I’ve excluded that from this course. The reason for it is different countries have different rules for filing taxes, so the items that can be processed as expenses are all different. Also, I actually don’t file my own taxes. I think I’ve mentioned it somewhere in a blog post, but I’ve hired a smart accountant (In Canada, it’s the accountant’s job) to whom I handed over the job, and he usually ends up adding a whole lot of items I never would have imagined were possible as expenses, and it saves me a lot of time not having to file my own taxes. It is a bit pricey, but in my experience, hiring a specialist has more advantages despite the cost. Another reason I won’t go into taxes is because depending on your business type, there are different ways of filing, and my accountant also takes care of my income tax (and all the deductions that come with it), so these are all out of the scope of this course. However, to add a few more thoughts, I’d advise you not to be too stingy when it comes to hiring an accountant. Look for a competent one who understands your business inside out and will look over it carefully for you. In my experience, this has proved to be a far more profitable route.

In the next lesson, we’ll take a step by step look at how to make an invoice.